28th October 2019

In recent years the use of a company car has proven to be a very costly taxable benefit in kind, however, from 6 April 2020 that is set to change for electric cars. With 50% of new cars obtained by companies, the changes in Benefit in Kind (BiK) represents an important move by the Government to encourage the adoption of the lowest emitting company vehicles.

Currently, the taxable BiK of an electric car is based on the original list price of the car multiplied by 16%. However, from 6 April 2020 that multiplier is going to significantly reduce to 2% (there is a strong possibility this could even go down to 0%). So if you had a company electric car with a list price of £40,000, the taxable benefit in kind value in the 2019/20 tax year is £6,400, but in 2020/21 it will decrease to £800 or £0!

It is also worth noting the significant corporation tax relief available to the company for the purchase of such vehicles that currently exist and will remain in place. 100% first year allowances are available on the purchase of new and unused electric cars. This is compared to a writing down allowance of 18% or 8% that is normally given to cars on purchase.

Low Emission/Hybrid Cars

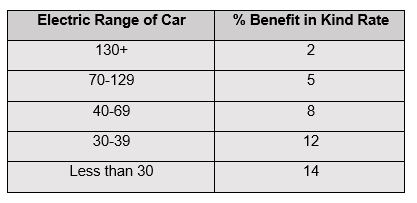

For company cars with a CO2 rate between 1-50 g/km the BiK can also be as low as 2% from 6 April 2020. In determining whether or not this low rate applies you need to consider the electric range of the vehicle. In short the longer the electric mileage range the lower the percentage rate will be in determining the BiK.

The BiK rates that will be applied for cars with a CO2 rate between 1g/km and 50g/km from 6 April 2020 are summed up in the table below:

The 100% First Year Allowance described above, is also available on the purchase of cars with a C02 rate of 50g/km or less. Providing the vehicle is purchased new and unused.

The Government said that ‘by providing clarity of future the appropriate percentages, businesses will have the ability to make more informed decisions about how they make the transition to zero emission fleets’. It added: ‘Appropriate percentages beyond 2022-23 remain under review and will be announced at future fiscal events.

If you wish to discuss these changes and how they will impact your tax planning strategies, please contact one of our Exeter or Exmouth Partners, or one of our tax specialists on 01392 258553 or 01395 279521 to arrange a free initial meeting.